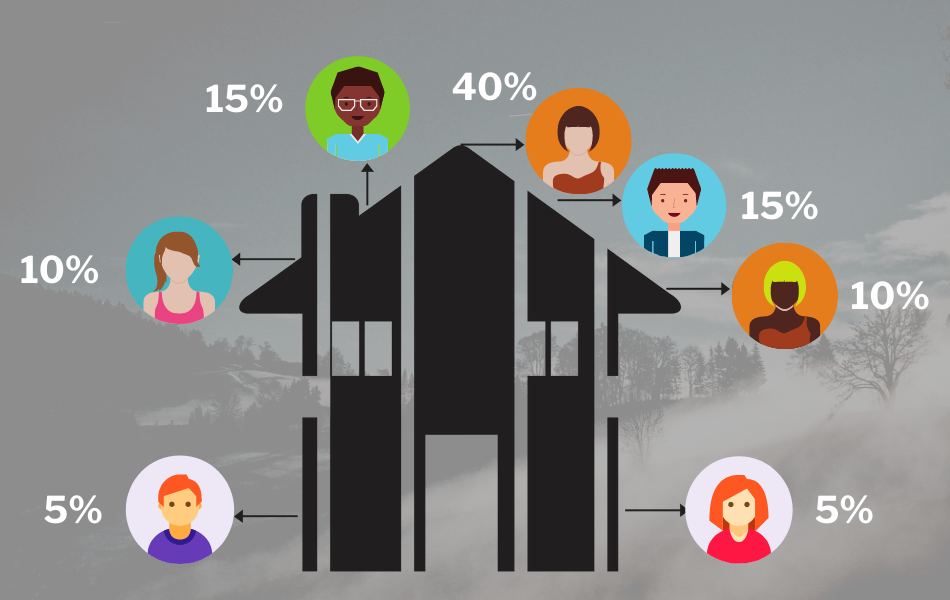

The CHALLENGE

Nigeria presently has a housing deficit of 20 million housing units; unfortunately, only 55,000 housing units are built annually. Even worse, 99% of Nigerians don’t own any of these houses.

To avert a full blown crisis, residential real estate must be re-invented.